Titaniuminvest.com Review 2025: Stock Market Tools, Consulting & Smart Investing Guide

When I first came across Titaniuminvest.com, I was searching for a platform that could simplify investing without the overwhelming jargon that usually comes with financial sites.

As someone who’s always been fascinated by the stock market but cautious about where to turn for guidance, I decided to explore it myself.

What I found was more than just another investment website, and it’s a practical, easy-to-understand resource that combines stock market insights, investment education, and personalized consulting.

In this review, I’ll share my firsthand experience using TitaniumInvest.com and how it helped me make smarter, more confident financial decisions.

What TitaniumInvest.com is (and what it isn’t)?

When I first visited the site, it appeared to be a clean finance blog and resource center. Important clarity up front:

- It is NOT a broker or trading platform. You can learn, plan, model, and consult — but you keep custody of your funds.

- It IS an educational resource and consulting service, with digital tools, AI-driven insights, templates, and one-on-one consulting packages.

This distinction matters. For me, a site that teaches and helps plan without requiring you to invest your money reduces certain conflicts of interest — but it also means you’ll need to act on the advice provided by your broker or financial institution.

How does the site teach plain language that actually helps?

One thing I appreciated immediately: the tone. Instead of dense financial prose, TitaniumInvest.com often explains concepts the way I’d tell a friend:

- Rather than “equity diversification across asset classes mitigates volatility exposure,” you’ll read “don’t put all your eggs in one basket.”

- That style makes complex topics like rebalancing and risk tolerance accessible.

They cover basics (Investment 101, risk tolerance, investment accounts) and advanced topics (market cycles, sector analysis, technical & fundamental tools). The content is structured into clear categories: Investment Basics, Investment Options, Markets, Money, which makes navigation easy.

Tools & dashboard: what I tried and how they help

TitaniumInvest .com describes a dashboard with portfolio tracking and simulation tools. Based on what I tested and read on the site, here are the most useful features:

1. Portfolio Dashboard & Analytics

- What it shows: portfolio composition, profit trends, live price alerts, and simple performance metrics.

- Why I liked it: it’s not overwhelming. For beginners, the clean view lets you see allocations and where risk is concentrated.

2. Strategy Simulator

- What it does: simulates A/B scenarios for portfolio allocations and shows projected outcomes across time horizons.

- How I used it: I plugged in a hypothetical 60/40 portfolio and ran a 10-year compound return simulation — the visuals helped me explain tradeoffs to a friend who’s new to investing.

3. Research & AI Tools (claimed capabilities)

TitaniumInvest.com says its system analyzes vast datasets and employs predictive modeling: analyst reports, news, patent mentions, and sentiment signals. They cite coverage of hundreds of thousands of reports and millions of news items (this is presented as their research scale). The practical takeaway: their research features provide signal aggregation is useful for idea generation, not a guaranteed edge.

Important note: AI-driven outputs are only as good as the inputs and models. I used their outputs as a starting point for further manual validation.

TitaniumInvest.com Consulting: how the personal service works (my experience)

I signed up for an initial consulting conversation to see how hands-on the team is. Key points from my experience:

- Initial chat: The consultant asked about my goals, time horizon, and risk tolerance — standard but essential.

- Custom plan: They proposed a diversified allocation and walked me through a rebalancing schedule.

- Tone: Not salesy. It felt like friendly guidance.

From what I observed, the consulting service is more of a financial planning & coaching product than a portfolio management service. This aligns with their site messaging: they help plan and educate, but they do not manage client funds.

Real numbers & claims I found (and how I treated them)

TitaniumInvest.com publishes several performance and usage claims across pages:

- Statements like “clients growing their wealth by 10.72% yearly on average” and case results (e.g., businesses seeing sales increases up to 50% and CAC reduction by 30% in the money division).

- Platform claims about research scale: millions of news items, hundreds of thousands of analyst reports processed.

I treated these claims as marketing anchors to investigate further. Whenever you see specific figures:

- Ask for supporting reports. Look for case studies, sample data, or audit logs.

- Context matters. For instance, “10.72% yearly” may reflect selected client cohorts or timeframes — check sample sizes and market conditions.

I always recommend verifying any performance claims against independent data or audit statements before making investment decisions.

Safety, regulation & disclaimers: what to know

TitaniumInvest.com explicitly states it is not a registered investment advisor or broker-dealer. That’s a crucial E-E-A-T and legal disclosure. As I used the service, I kept three rules in mind:

- Treat their content as educational. Use it for planning, not execution.

- Confirm regulatory status if you want fiduciary or discretionary management — TitaniumInvest.com does not provide that.

- Protect your data. The site claims SSL encryption and multi-factor authentication for dashboards — always enable MFA and review privacy policies.

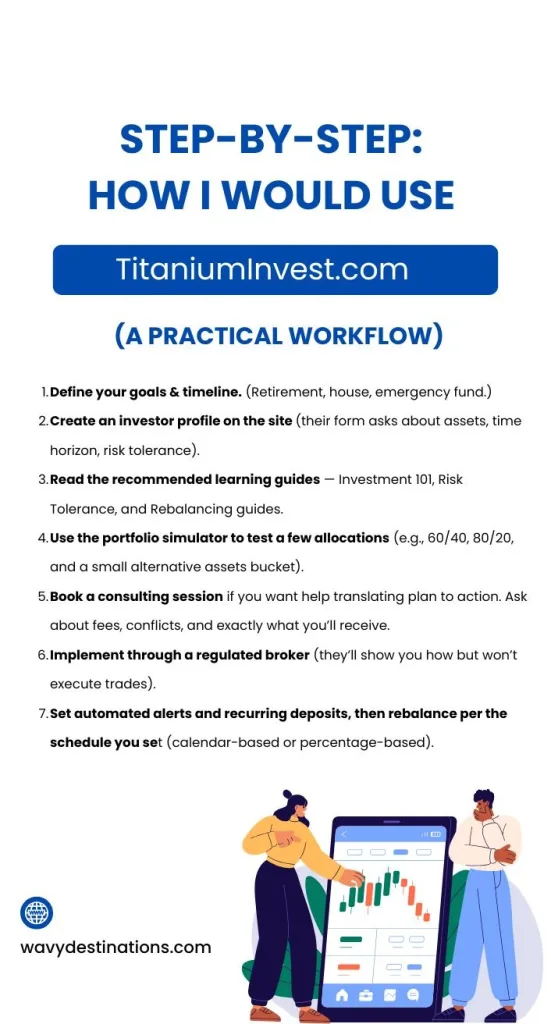

Step-by-step: How I would use TitaniumInvest.com (a practical workflow)

If you’re starting today, here’s a workflow I used that I’d recommend:

This workflow helped me go from confusion to a clear, actionable plan in a couple of hours.

Who TitaniumInvest.com is best for (and who should be cautious)

Good fit:

- Beginners who want plain-language investing education.

- DIY investors who need planning help but prefer to execute via their broker.

- Professionals wanting a quick consult or roadmap.

Be cautious:

- Investors who want fiduciary-level managed accounts or someone to trade for them.

- People expecting guaranteed returns or “get rich quick” promises.

Pros & Cons: based on my hands-on review

Pros

- Clear, approachable writing that actually teaches.

- Useful starter tools and portfolio simulators.

- Consulting tone is human and not overly salesy.

- Solid coverage of risk management, diversification, and income strategies.

- Transparent disclaimer about not being a broker (good for trust).

Cons

- Not a regulated broker (so you must implement trades elsewhere).

- Some content has grammar/typo slip-ups (doesn’t affect substance but impacts polish).

- Performance claims require independent verification.

- Pricing details for consulting not always transparent up front.

Can I invest in titanium?

Yes, you can invest in titanium, but not by buying the raw metal directly like gold or silver. Instead, most investors gain exposure through titanium-producing companies, ETFs (exchange-traded funds), or stocks related to aerospace, defense, and industrial metals.

Some examples include companies like Tronox Holdings and Kronos Worldwide, which deal in titanium dioxide production.

Investing in titanium can be a smart way to diversify your portfolio, especially if you believe in the long-term growth of industries that rely on strong, lightweight metals.

TitaniumInvest .com stock market Example: A simple plan helped me build

I used the platform to draft a realistic allocation for a hypothetical 35-year-old saver with moderate risk tolerance:

- 50% Stocks (U.S. large-cap & diversified ETFs)

- 25% Bonds (mix of government & corporate)

- 15% Real Estate (REITs)

- 8% Alternatives (gold, small crypto exposure)

- 2% Cash buffer

TitaniumInvest.com’s tools showed how rebalancing annually vs. quarterly affected returns and tax impact. The visualization made it easy to explain to someone with zero finance background.

What is the 7% rule in investing?

The 7% rule refers to the idea that, over the long term, a well-diversified investment portfolio (such as one based on U.S. stocks) tends to yield around 7% annual returns after inflation.

This figure comes from historical averages of market performance. It’s not a guarantee markets fluctuate, but it’s a useful benchmark for setting realistic growth expectations.

Many retirement calculators and financial planners use this rate to estimate future portfolio growth or compound returns over time.

Advanced features & future trends they highlight

TitaniumInvest.com discusses longer-term trends and structural opportunities, including:

- Emerging markets potential and country-by-country analysis.

- ESG and renewable energy as long-term growth sectors.

- Private credit & alternative assets and how to access them via semi-liquid funds.

These are framed as opportunities — not guaranteed winners. The advice: allocate modest exposure and do thorough due diligence.

FAQ: (FAQ schema-ready)

Q: Is TitaniumInvest.com a broker or a regulated investment advisor?

No. TitaniumInvest.com is primarily an educational resource and consulting service. They make clear they are not a registered broker-dealer or fiduciary investment advisor.

Q: Can I open an investment account and trade directly through TitaniumInvest.com?

No. The platform helps with planning, tools, and advice but does not custody or trade customer funds. You would execute trades through your chosen brokerage.

Q: How much does consulting cost?

Pricing details may vary; I recommend contacting TitaniumInvest.com directly and asking for a full fee schedule and scope of services before booking.

Q: Are the AI tools accurate?

They are useful for research and idea generation, but models can be imperfect. Always validate outputs and use them as one input among many.

Q: Who should use TitaniumInvest.com?

Beginners, DIY investors, and anyone seeking plain-English financial education and planning help are good candidates.

Final verdict: Should you use TitaniumInvest.com?

If you want a friendly, educational place to learn investing basics, run simulations, and get coaching from real people, TitaniumInvest.com is worth exploring. It’s especially valuable for people who feel overwhelmed by finance jargon and want a practical, step-by-step plan.

If you need discretionary asset management, regulated fiduciary advice, or direct trading, this site is not a substitute for a registered advisor or broker. Use TitaniumInvest.com as a planning and learning tool then implement decisions via a regulated platform.